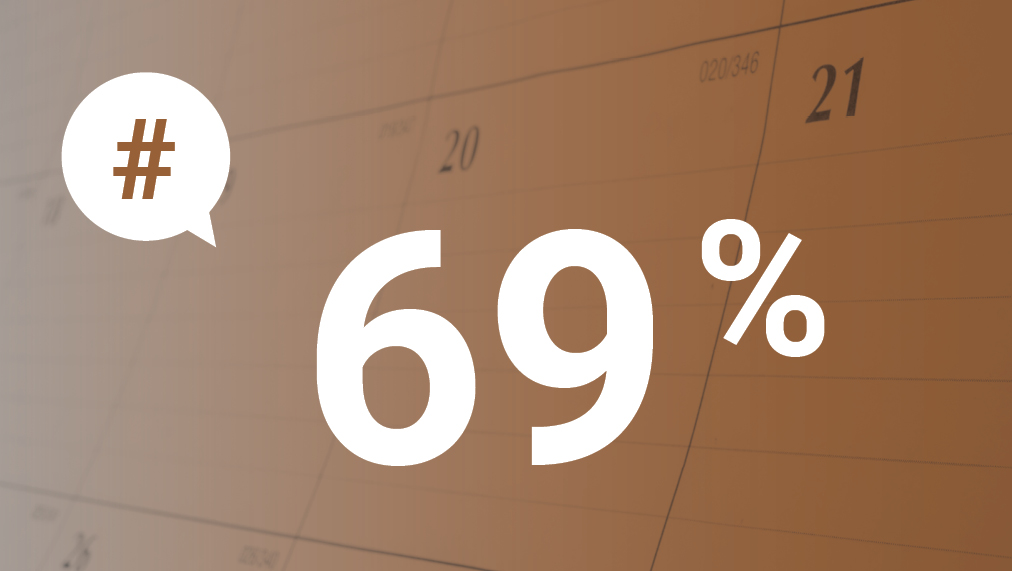

According to a survey commissioned by FP Canada last year, the rising cost of groceries is the top external factor in the financial stress felt by Canadians, ahead of inflation in general (mentioned by 63% of respondents), gas prices (49%), high interest rates (33%) and mortgage rates (22%). Moreover, the percentage of Canadians who say that they are feeling less hopeful about their financial future has risen since last year, from 39% in 2022 to 44% in 2023.

The survey, carried out by Léger, indicated again this year that good planning is an effective antidote for financial stress: Canadians who deal with a financial planner are more likely than their peers to feel confident about their financial future (59% vs. 46%) and are less likely to lose sleep over financial matters (38% vs. 49%).

One more reason to check in with your advisor as the new year begins?

______

The following sources were used to prepare this article:

FP Canada, “FP Canada™ 2023 Financial Stress Index , You will be redirected to an external website..”